With this list of the top 10 best apps to save money in Nigeria in 2024, you can make your money management easier and more effective.

With so many mobile apps available now, saving money is easier than ever. Additionally to helping you keep track of your spending, these apps provide budgeting tools, cashback rewards, and investment opportunities.

Join us as we bring to you the top 10 best apps to save money in Nigeria in 2024

Also See: Best Sites to Sell Online for Free in Nigeria

Best Platform To Save Money In Nigeria

Let’s take a look at some of the best online platform you can use to save money online in Nigeria with their features and benefits.

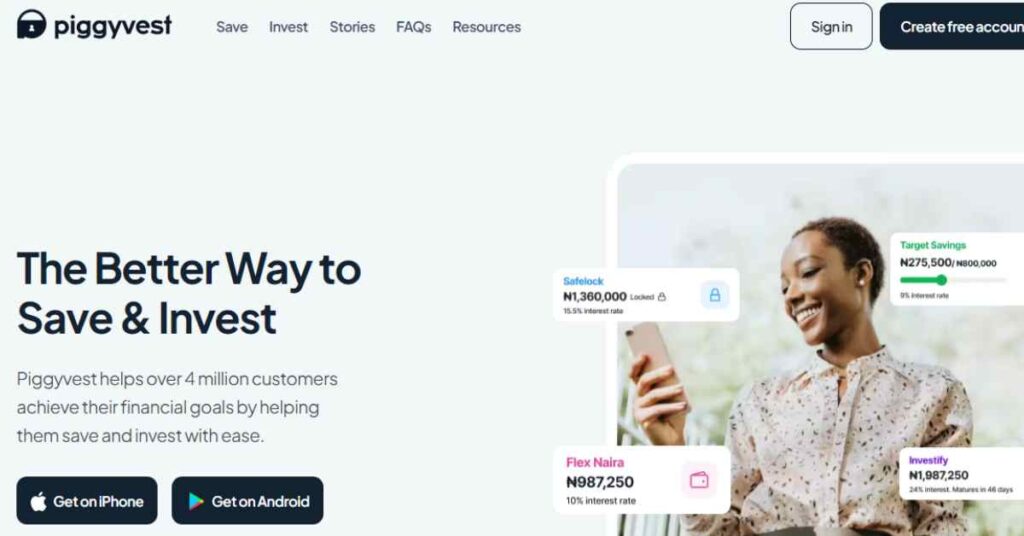

#1. Piggyvest:

For Nigerians looking to save and invest, PiggyVest is a top choice. Its user-friendly layout and robust features have contributed to its exponential growth since its founding in 2016.

With over 4.5 million users and a payout of over ₦1.1 trillion ($1.42 billion) to its name, Piggyvest has dominated the West African savings and investment app market since its launch in 2016.

Features and Benefits

- Savings Plans: You can choose from Autosave, Target Savings, Quicksave, Safelock, and Flex Dollar as your savings plans.

- Interest Rates: Depending on the deal you choose, you could earn between 10% and 13% interest per year.

- Investments: Put your money into opportunities that have already been checked out and could see returns of up to 25% per year.

- Security: Since Piggyvest is regulated by the SEC, your money is safe as if it were in a bank.

- Easy to Use: A mobile app that makes it easy to keep track of progress.

#2. FairMoney

When it comes to savings, FairMoney, a top digital bank, has two great options: FairSave and FairLock.

Although FairSave gives you quick access to your money and a high interest rate of 14%, FairLock offers fixed deposits with even higher interest rates (up to 24%) but a lock-in time.

Features and Benefits

- Benefits: Very high interest rates, flexible and fixed deposit options.

#3. ALAT by Wema

Wema Bank app which is called ALAT is a full-featured digital banking experience that focuses on saving and investing.

Users can open a savings account, set goals, and configure automatic deposits with competitive interest rates (up to 10% p.a.).

ALAT also gives investors access to treasury bills and mutual funds.

Features and Benefits

- Savings Goals: Set and track your financial goals.

- Interest Rates: Competitive rates.

- Mobile Banking: Convenient access.

#4. Cowrywise:

Cowrywise is a web-based savings app that offers several savings plans, including emergency savings accounts, short-term and long-term savings plans, and more.

You can earn interest on your savings of up to 12% with this app. You can also invest in mutual funds and set up automatic savings.

#5. Kuda Bank

Kuda Bank is a digital-only financial institution that launched in 2019 and is well-known for its budgeting and fee-free banking services.

Customers may take advantage of attractive interest rates on a high-yield savings account that also lets them establish spending limits and keep good track of their expenditure.

Features and Benefits

- Zero fees, budgeting tools, high-yield savings account.

- Interest Rates: Competitive returns.

- Budgeting Tools: Helps manage expenses.

#6. Jollof+ by Baobab

You may expect excellent returns on your investments with an industry-leading interest rate of up to 21.60% net per annum.

Jolloflock, their fixed deposit feature, lets you lock your cash for a certain length of time. Your money can grow with Jolloflock at a rate of up to 21.60 percent net interest each year.

You can still earn up to 21% interest on your savings after taxes and other deductions. You can find the monthly interest calculation on the website.

#7. VBank

The VBank app is a digital banking service that gives customers access to an array of methods for managing their finances, including numerous savings alternatives.

Features and Benefits

- Zero account maintenance fees

- Savings and investment options

- Budgeting and expense tracking

#8. Rubies

The Rubies app is a savings application that provides users with many kinds of savings strategies, including daily, weekly, and monthly plans.

There are almost 200,000 registered users, and it provides interest rates that may reach up to 10% each year

#9. Trove

Trove is an investment application that gives users the opportunity to invest in stocks, real estate, and other assets.

It has more than 50,000 members and provides returns of up to 20% each year

#10. Carbon

Carbon is an all-encompassing financial management application that was formerly known as Paylater.

It helps users manage their finances by providing services such as loans, bill payments, and savings.

Features and Benefits

- High-yield savings accounts

- Instant loans with favorable terms

- Cashback on bill payments and purchases

- Financial health tips and tools

How to Choose the Right Money-Saving App?

Since there are so many money saving apps to choose from, the best app for saving money will rely on your needs and financial goals.

Below are some important things to consider when choosing a saving application.

Savings Objectives: Are you putting money down for a short-term objective, such as a trip, or a long-term one, such as retirement?

Interest Rates: In order to optimize your earnings, it is important to compare the interest rates that are given by various applications.

Features: Take into consideration if you want simple savings functionality or features such as tools for budgeting, investment alternatives, or social saving features.

Fees: Some apps impose fees, either on a monthly basis or on a transaction-by-transaction basis.

Security: Choose an application that has a solid reputation for security and that has been granted a license by the Central Bank of Nigeria (CBN).

What Is The Best App To Save Naira To Dollars?

When it comes to saving naira to dollars, there is not a single “best” app for everyone as several apps offer various features and advantages, however we are going to give you the top three contenders of the best apps for saving in dollars

Piggyvest:

Piggyvest fintech app is a mobile savings app that supports both US dollars and Nigerian naira.

If you wish to save in US dollars, you’ll have to open a piggy flex account in Nigerian naira and move the funds there.

The Flex Naira wallet lets you earn up to 10% per year, paid at the beginning of the month, as long as you don’t withdraw more than 4 times to your bank account. Interest is calculated daily and paid accordingly.

Cowrywise

Cowrywise is a mobile platform that makes it easier to save money and make investments in dollars. Aside from monetary savings

Rise

The Rise app is a financial technology that helps Nigerians save dollars and earn good returns.

It also lets users invest in dollar-denominated assets that might earn returns, and anyone can use it, no matter how much initial investment you have

What Is The Best Platform To Save Money?

In terms of Money-Saving Apps, the best platform to save money will depends on your needs and goals.

If you are saving because of interest rate then you will have to look for platforms that offer good interest rate on savings such as Fairmoney which offer interest up to 24% and Jollof+ by Baobab which also offer up to 21% interest.

Conclusion

Whether you’re looking to automate your savings, invest in various opportunities, or simply manage your finances better, these top 10 best apps to save money in Nigeria in 2024 offer the tools and resources needed to achieve your financial goals.

Nigerians can properly handle their money better, reach their financial targets, and create a safe financial future by using smart financial practices and the capabilities of money saving mobile apps.

Disclaimer: The information given in this post is for general informational reasons only and should not be taken as financial advice. Always conduct your own research and consult with a qualified financial professional before making any financial decisions.

- Current Price Of Tokunbo Toyota Venza Engine In Nigeria - November 14, 2024

- Prices Of The Best Natural Hair Products in Nigeria - October 31, 2024

- Current Price Of Tokunbo Mercedes-Benz GLK-Class Engine In Nigeria - October 26, 2024

Pingback: Top 10 Best Online Virtual Banks in Nigeria (2024) -