In recent years, there has been a huge increase in the number of active bank accounts in Nigeria. This trend is a big step towards financial equality, which is very important for economic growth.

In this post, we will look at how many open bank accounts there are in Nigeria right now, what’s causing this growth, and what it means for the future.

Check also: Facts About Nigerians and Cryptocurrency (Statistics, Facts & Usage Trends)

How Many Bank Accounts Are There in Nigeria?

The latest information from the Nigerian Inter-Bank Settlement System (NIBSS) shows that the number of active bank accounts has grown by an amazing amount.

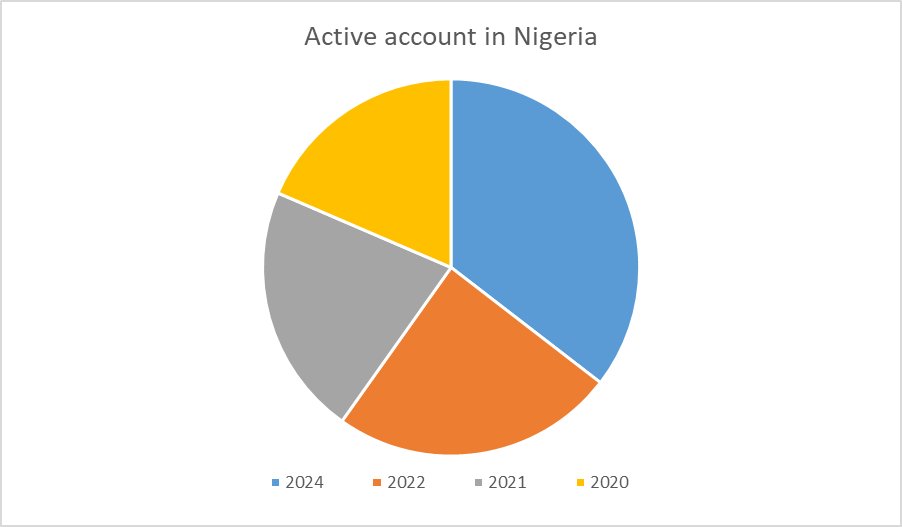

The highest number ever was 219.6 million in March 2024.

There were 151 million active accounts at the end of 2022, so this is a big increase of over 68.6 million in just 15 months.

Data provided by Statista indicates that there were approximately 134 million active bank accounts in Nigeria in the year 2021.

The number of customers increased by around 69 million as compared to the previous year 2016.

Over 122 million active bank clients were included in the total number of customers in the same year.

According to the World Bank, the percentage of Nigerians who had accounts at regulated institutions such as a bank, credit unions, microfinance institutions, post offices, or mobile money service providers went up by sixteen percent to forty-five percent in the year 2021.

Pie Chat representing the number of active bank accounts in Nigeria for the year 2020, 2021, 2022 and 2024

How many people in Nigeria have bank accounts?

In the year 2021, Nigeria had a total of 122.3 million active bank customers.

In comparison to the previous year, 2016, the number of customers surged by more than sixty million, according to data from Statista.

It is estimated that there are more than 200 million people living in the country, with the adult population accounting for more than half of the total population as of the year 2021.

The World Bank asserts that the proliferation of mobile money could be attributed to the increase in account ownership in Nigeria and other countries in Sub-Saharan Africa.

The report indicated that in the year 2021, 55 percent of individuals in Sub-Saharan Africa had an account, with 33 percent of those adults having a mobile money account.

This data represents the highest percentage of any region in the world, and it is more than three times higher than the global average of 10 percent for mobile money account ownership.

Factors Contributing To The Rise In Bank Account Holders In Nigeria

What’s making this high growth rate in account holders Happen? Let’s see some of the key drivers.

Initiatives for Financial Inclusion:

The Central Bank of Nigeria (CBN) has put in place various policies that are meant to help more people get access to money.

Some of these initiatives are making it easier to start an account, getting more people to use mobile banking, and expanding the network of agency banking in rural areas.

Increase in Mobile Money:

The growth of mobile money services like MOMO, Airtel Money, and Online-Only Microfinance Banks such as Opay, kuda, Monie Point, etc, has influenced the rate of account opening in Nigeria.

These platforms make it easy and cheap for people who don’t have bank accounts to access financial services, especially those who live in remote areas.

Increased Digital Literacy:

More people having access to the internet and smartphones which has led to an increase in digital literacy.

More and more Nigerians are getting used to managing their money through online banking and mobile banking apps.

Government Programmes:

Conditional Cash Transfers and social intervention programs like N-Power send money online into the bank accounts of eligible people, which has accidentally led people who didn’t have bank accounts before to open them.

E-commerce Takes Off:

Nigeria’s booming e-commerce scene means that people who want to buy things online need to have bank accounts.

This has made people, especially younger people, more likely to start accounts and join the digital economy.

Formalization of the Economy:

The government’s efforts to make the unorganized sector more like the formal sector have pushed businesses to start using bank accounts for transactions.

Such government intervention makes things more clear and makes it easier to get credit.

How Many Banks Are There In Nigeria?

The Central Bank of Nigeria (CBN) has given licenses to 25 commercial banks right now.

The CBN website says that this information is correct as of Thursday, March 14, 2024.

List of the commercial banks licensed by CBN in Nigeria

1 Access Bank Plc

2 Citibank Nigeria Limited

3 Ecobank Nigeria Plc

4 Fidelity Bank Plc

5 First Bank Nigeria Limited

6 First City Monument Bank Plc

7 Globus Bank Limited

8 Guaranty Trust Bank Plc

9 Heritage Banking Company Ltd.

10 Keystone Bank Limited

11 Optimus Bank

12 Parallex Bank Ltd

13 Polaris Bank Plc

14 Premium Trust Bank

15 Providus Bank

16 Stanbic IBTC Bank Plc

17 Standard Chartered Bank Nigeria Ltd.

18 Sterling Bank Plc

19 SunTrust Bank Nigeria Limited

20 Titan Trust Bank Ltd

21 Union Bank of Nigeria Plc

22 United Bank For Africa Plc

23 Unity Bank Plc

24 Wema Bank Plc

25 Zenith Bank Plc

How Many BVN Holders Are There In Nigeria?

The Nigeria Inter-Bank Settlement System has said on its website that the current number of BVN is 61,166,384 as of March 2024.

NIBSS says that BVN gives bank account holders a unique name that can be checked across the Nigerian banking industry.

It also keeps people from getting into other people’s bank accounts without permission.

NIBSS stressed the importance of the number by saying that there was a high demand for stronger security for accessing private or secret information in the banking system because traditional security systems (password and PIN) were being broken into more often.

The $50 million BVN project was started on February 14, 2014, by the Central Bank of Nigeria (CBN), the Bankers’ Committee (NIBSS), and a German company called Dermalog.

Its goal is to collect biometric information from all bank customers and issued to them a unique identity that can be checked across the Nigerian banking industry.

The Way Ahead: A Future of Finances for Everyone

The huge rise in active bank accounts in Nigeria is a good sign that the country’s financial system is becoming more open to everyone.

Nigeria can solidify its place as an African leader in financial inclusion by tackling the remaining problems and encouraging more new ideas.

Here are some possible places to explore in the future:

Expanding Agent Banking Networks: Making agent banking networks even bigger will bring important financial services closer to people who don’t have bank accounts, especially those who live in areas that aren’t well covered.

Promoting Financial Literacy Programmes: The government and financial institutions can work together to create complete programmes that teach people how to handle their money safely and responsibly.

Using Fintech Innovation: Fintech startups can be very helpful in creating new financial goods and services that meet the needs of people who don’t have bank accounts or don’t have enough money in their accounts.

Using biometrics: Biometric technologies, such as fingerprint scanners and face recognition, can make it safe and easy to access your account, especially for people who don’t have traditional IDs.

Improving Regulatory Frameworks: Regulatory bodies can create flexible and open-minded regulatory frameworks that support responsible innovation while keeping the economy stable and protecting consumers.

Conclusion on Number Of Active Bank Accounts In Nigeria 2024

The large increase in the number of active bank accounts in Nigeria is a big step towards financial inclusion for the whole country.

This trend has a huge chance to give people more power, boost the economy, and make everyone in Nigeria’s financial future better.

All the people involved can make sure that this growth lasts and helps everyone by working together to solve problems and be open to new ideas.

The rise in active bank accounts is more than just a number; it’s a change agent that will lead to a more successful and inclusive Nigerian economy.

- Current Price Of Tokunbo Toyota Venza Engine In Nigeria - November 14, 2024

- Prices Of The Best Natural Hair Products in Nigeria - October 31, 2024

- Current Price Of Tokunbo Mercedes-Benz GLK-Class Engine In Nigeria - October 26, 2024

Pingback: Facts About Nigerians And Cryptocurrency (Statistics, Facts & Usage Trends) -

Pingback: Number Of Smartphone Users In Nigeria (A detail Analysis) -

Pingback: 2024 Nigerian Bank USSD Codes List: UBA, GTB, FBN, Access, FCMB and More -