Nigerians who live busy lives nowadays require easy-to-use and safe financial management solutions. USSD (Unstructured Supplementary Service Data) codes offer that solution, which lets you do necessary banking operations straight from your cell phone—no internet connection necessary!

You can find the most recent USSD codes for leading Nigerian banks in this thorough 2024 reference, including UBA, GTB, FBN (First Bank), Access Bank, FCMB (First City Monument Bank), and more.

- Need to do banking without internet access in Nigeria?

- Looking for Nigerian bank USSD codes for 2024?

- Want to make fast and secure transactions with your Nigerian bank account?

This post is for you!

Read also: Number Of Active Bank Accounts In Nigeria 2024

What Are USSD Codes?

Like regular phone calls, USSD codes (Unstructured Supplementary Service Data) are short numbers that you enter into your phone’s dial pad.

You can do things like check your balance, send money, or purchase airtime with the help of these codes, which open up a special menu on your bank’s network.

USSD codes are great for people who don’t have access to the internet or who have older, more basic, non-smartphones.

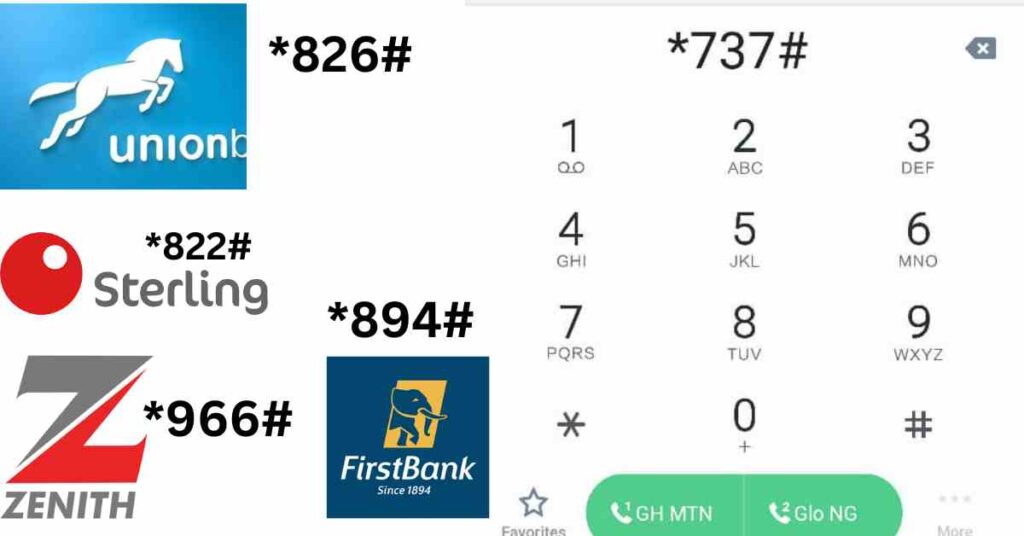

2024 List of Nigerian Bank USSD Codes

| BANK | USSD CODE | TRANSACTION |

| UBA (United Bank for Africa) | *919# | Account balance, transfer funds, buy airtime, pay bills |

| GTBank (Guaranty Trust Bank) | *737# | Check account balance, transfer funds, buy airtime, pay bills |

| FBN (First Bank of Nigeria) | *894# | Check balance, transfer funds, buy airtime, pay bills |

| Access Bank | *901# | Account balance, transfer funds, buy airtime, pay bills |

| FCMB (First City Monument Bank) | *329# | Check balance, transfer funds, buy airtime, pay bills |

| Zenith Bank | *966# | Check balance, transfer funds, buy airtime, pay bills |

| Union Bank | *826# | Account balance, transfer funds, buy airtime, pay bills |

| Polaris Bank | *833# | Check balance, transfer funds, buy airtime, pay bills |

| Keystone Bank | *7111# | Account balance, transfer funds, buy airtime, pay bills |

| Sterling Bank | *822# | Check balance, transfer funds, buy airtime, pay bills |

| Stanbic IBTC Bank | *909# | Account balance, transfer funds, buy airtime, pay bills |

| Ecobank Nigeria | *326# | Check balance, transfer funds, buy airtime, pay bills |

| Heritage Bank | *745# | Check balance, transfer funds, buy airtime, pay bills |

| Wema Bank- ALAT | *945# | Check balance, transfer funds, buy airtime, pay bills |

| Fidelity Bank- | *770# | Check balance, transfer funds, buy airtime, pay bills |

| PalmPay | *652# | Account balance, transfer funds, buy airtime, pay bills |

| Opay | *955# | Account balance, transfer funds, buy airtime, pay bills |

P.S: Although this list provides a basic overview, individual features may differ slightly from one bank to another. It is highly recommended that you consult your bank’s website or mobile app to obtain the most recent information regarding USSD codes and a comprehensive list of online transactions.

Benefits of Using USSD Codes

- Convenience: You can manage your finances whenever you want, wherever you are, and without the need for an internet connection.

- Security: USSD transactions typically necessitate the use of a personal identification number (PIN) for the purpose of ensuring additional security.

- Accessibility: In terms of accessibility, it is compatible with almost all mobile phones.

- Transaction fees(usally N6.00) are often lower than those associated with online banking, making this method more cost-effective.

How to USSD Codes Securely?

Beware of phishing:

Under no circumstances should you ever reveal your personal identification number (PIN) or any other sensitive information through the use of USSD prompts.

Keep your PIN secure:

Protect your personal identification number (PIN) without disclosing it to anyone, and avoid writing it down.

Verify the code for the USSD:

Before you dial, make sure the code is double-checked to ensure it is your bank’s authentic code.

You can take advantage of the convenience of mobile banking while still ensuring the safety of your hard-earned money if you follow these guidelines and use the power of USSD codes.

Tips For Using USSD Codes:

(USSD) codes are a game-changer for mobile banking in Nigeria since they provide access to manage your finances while you are on the move without needing an internet connection.

However, to make the most of this ease and safety, the following are some vital tips:

1. Understand the Code of Your Bank:

One USSD code is assigned to every bank. You may find the most up-to-date code by visiting your bank or checking its website or mobile app, or you can refer to our full list in the previous section.

You shouldn’t rely on sources that haven’t been validated; a short search on the internet can verify the official code.

2. Make sure you commit your PIN to memory:

Your personal identification number (PIN) serves as a safeguard against transactions that are not authorized.

Commit it to memory and refrain from writing it down anywhere. Never reveal your personal identification number (PIN) to anyone, not even your close friends, family members, or bank employees.

3. Before you dial, make sure a double check:

A typo may occur, but it can be quite expensive when it comes to USSD codes. To guarantee that you are connecting to the legitimate service provided by your bank, you should check the code twice before dialling.

4. Be wary of scams that include phishing:

Using USSD prompts, phishing scams can target you as a potential victim. Alert yourself to messages that ask for private information, such as your personal identification number (PIN) or account details.

In the course of legitimate USSD contacts, such information will never be requested.

5. Careful While Navigating:

The USSD menus provide several different choices. Before deciding on an answer, make sure you have properly read each prompt.

Unintended consequences could result from making the incorrect choice.

6. Keep the Transactions Straightforward:

You should utilize USSD codes for fundamental operations such as checking your balance, recharging your airtime, and making modest transfers, even though they offer a wide range of functions.

When dealing with more complicated transactions, you might consider using secure Internet banking alternatives on your computer or phone.

7. Make sure your phone is protected:

Protect your phone with robust passwords or personal identification numbers (PINs) to prevent unauthorized access to your USSD banking options if your phone is misplaced or stolen.

8. Take Into Consideration the Transaction Limits:

The amount of money that can be sent or the number of transactions that can be completed using USSD codes may be restricted by certain financial institutions.

To minimize any hassles, you should become familiar with the exact constraints that your bank imposes.

9. Play around with the mobile app of your bank:

Numerous financial institutions provide mobile applications that offer a more extensive range of functionalities and maybe more powerful security features.

In spite of the fact that USSD codes are helpful for basic needs, you should think about exploring the mobile app that your bank offers for a more thorough experience.

FAQs – 2024 Nigerian Bank USSD Codes List: UBA, GTB, FBN, Access, FCMB and More

What is the new USSD code for FCMB?

The USSD code of FCMB is *329#. You can use *329# to perform different financial operations such as:

Checking your account balance: Dial *329*0#

Make transfer: dial *329*Amount*Recipient’s Account Number#.

Buy Air time: *329*Amount#.

Pay bills: *329*Amount*Merchant Code# to pay bills.

What are the codes for all banks?

Check the sections above for USSD codes for all banks

What is the new USSD code for GTB?

GTB has a USSD code of *737# and it has never changed for years.

What is the FBN code for USSD?

FBN has a USSD code of *894#

Conclusion – 2024 Nigerian Bank USSD Codes List: UBA, GTB, FBN, Access, FCMB and More

You may simplify your financial transactions and money management with the help of USSD banking. Knowing the 2024 Nigerian Bank USSD Codes List will make bank transactions without the Internet an easy task for you.

This post is just a starting point, so keep that in mind. Always consult banks resources for the most accurate and current information about your bank’s USSD services.

When used correctly, USSD banking in Nigeria can be a safe and easy way to manage your money.

- Current Price Of Tokunbo Toyota Venza Engine In Nigeria - November 14, 2024

- Prices Of The Best Natural Hair Products in Nigeria - October 31, 2024

- Current Price Of Tokunbo Mercedes-Benz GLK-Class Engine In Nigeria - October 26, 2024

Pingback: Top 10 Best Online Virtual Banks in Nigeria (2024) -